Model Portfolio: ROIC Value

The “ROIC Value” portfolio is our second published model portfolio in addition to the dividend portfolio published last month. The full portfolio which will eventually contain all 5 model portfolios is here.

ROIC or Return On Invested Capital is one of the most important investment metrics because it measures how well a company turns money into more money. It is so core that one of the best free financial data sites ROIC.ai is named after it.

Many stocks do not do this directly, they turn money into potential money. Google was a company that burned money and turned it into user activity. It was only after they started showing ads that this activity could then be converted into money.

While this worked out for Google, these promises don’t always work out. Twitter and Reddit have found it much more difficult to monetize their audience. Some companies like Medium are considered failures because their monetization is so mediocre and damaged their cultural relevance.

Focusing on ROIC allows us to find companies that have already found a valuable way of deploying capital in the present. However because such companies are obvious good buys and oversubscribed, this portfolio will focus on companies with a low Price to Book valuation.

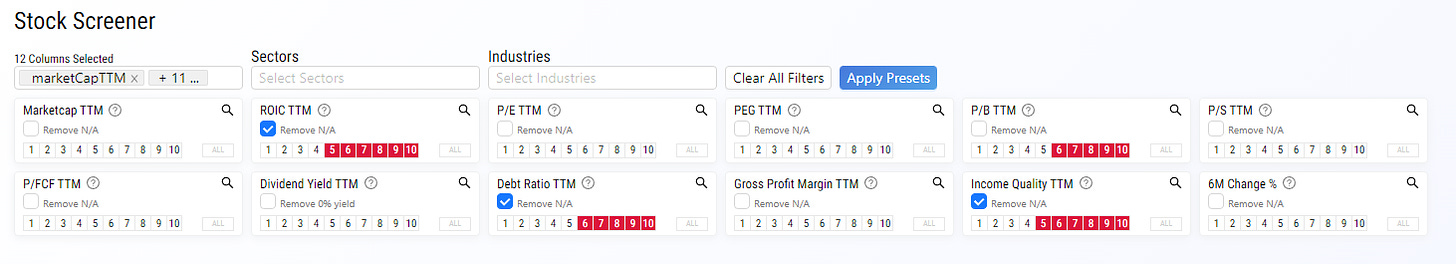

The screener used can be found at this URL and uses the following metrics:

Price to Book

ROIC

Income Quality

Debt Ratio

Below are a few stocks that made it into the portfolio. The final portfolio can be found below:

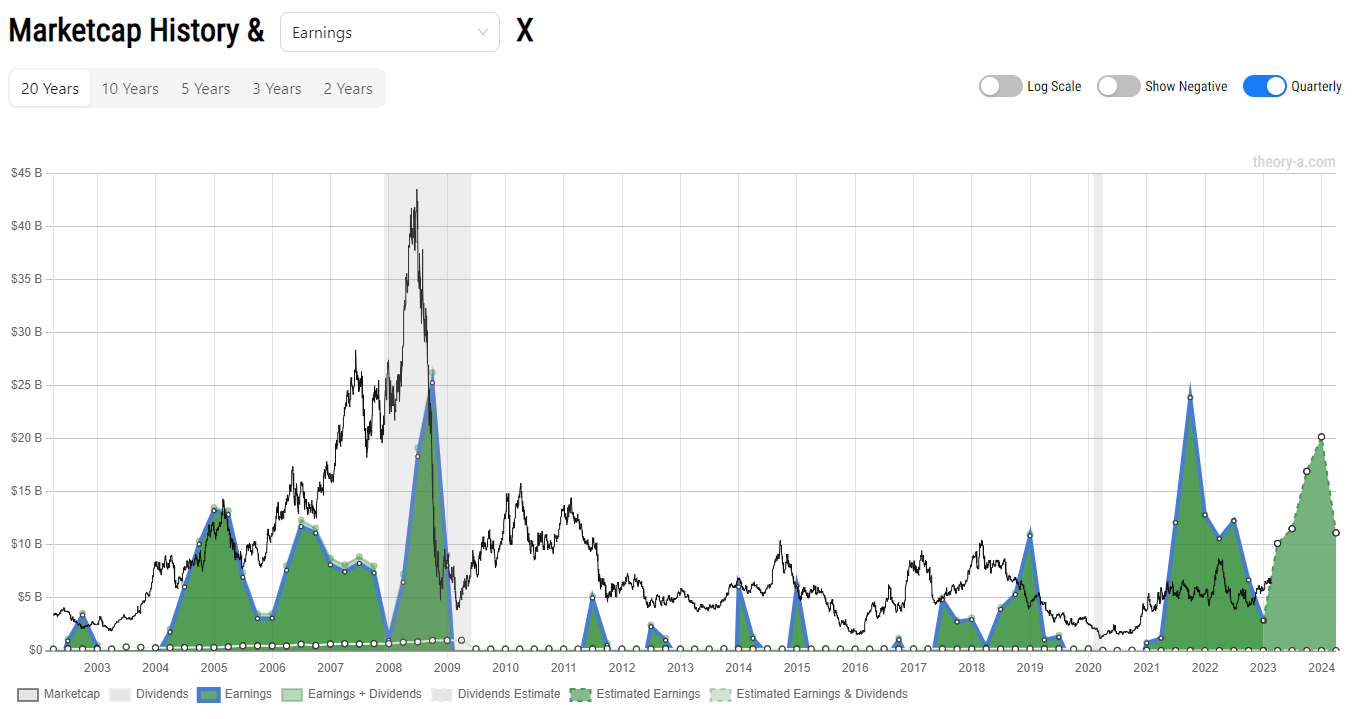

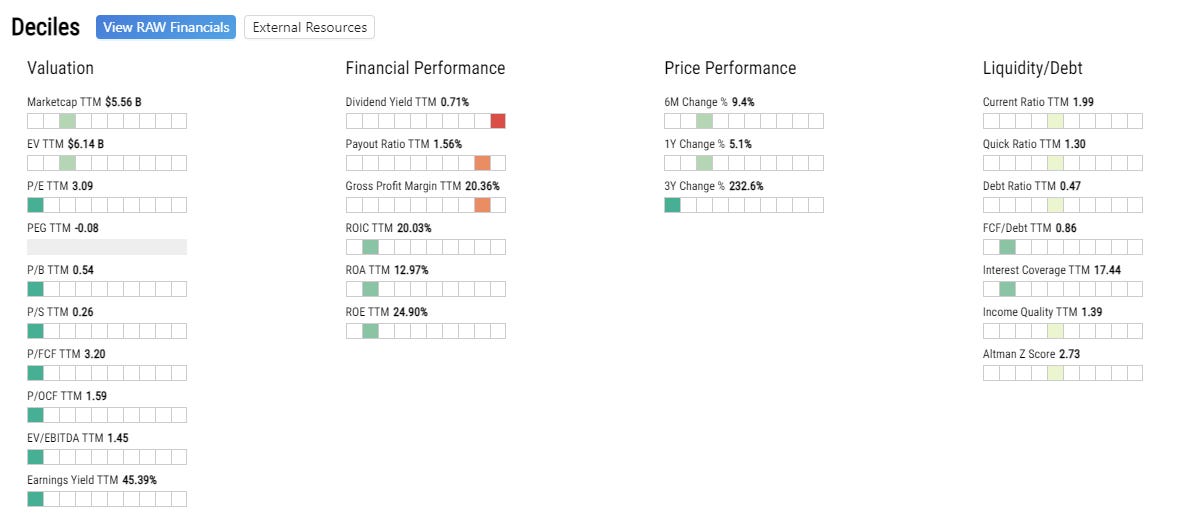

X United States Steel Corporation

United States Steel Corporation produces and sells steel products primarily in North America and Europe. It has a strong presence in key industries such as automotive, construction, and energy and will be a vital player in domestic growth of these industries especially given decreasing globalization and increased “friend-shoring” due to various political tensions.

Despite the runup from the 2020 stimulus it is still a very cheap stock based on many metrics.

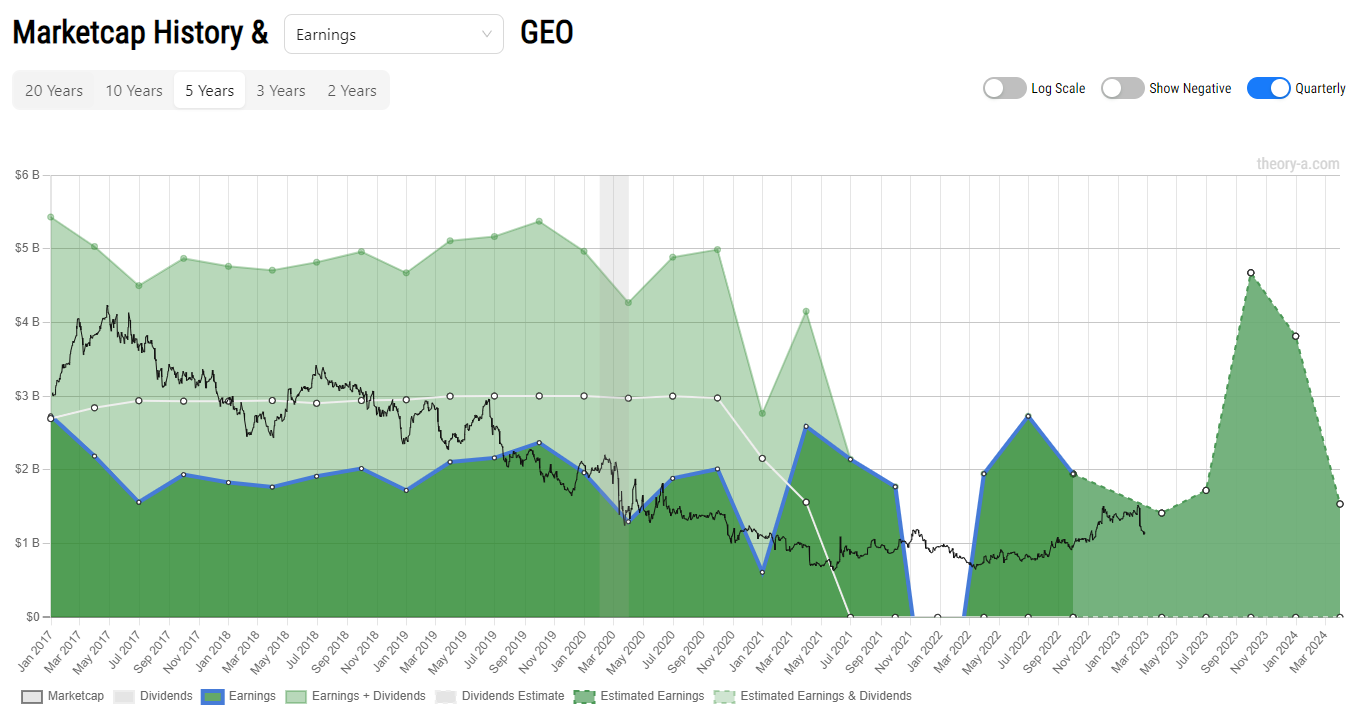

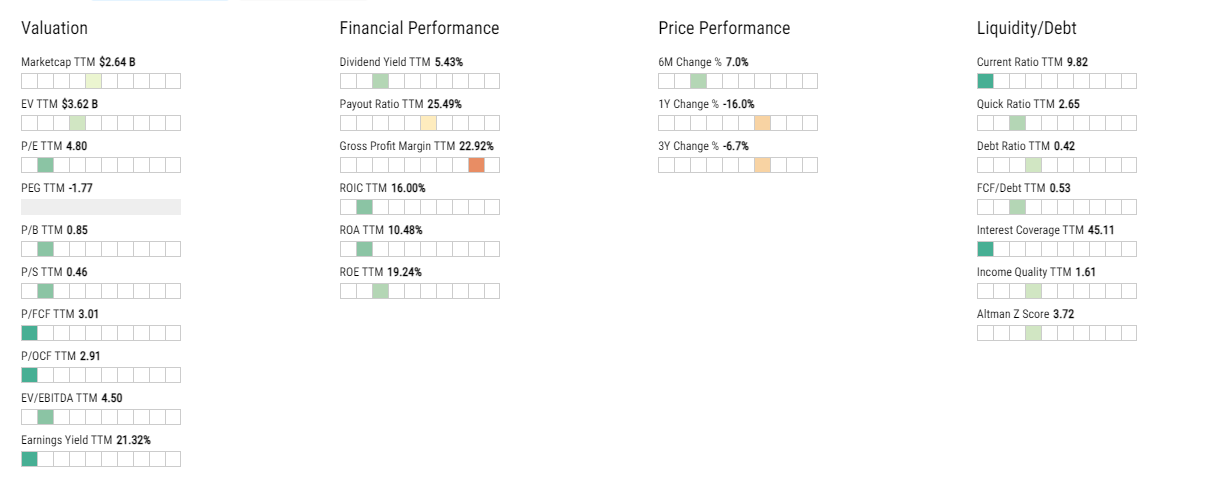

GEO Group

The GEO Group specializes in development of support services for secure facilities, processing centers, and community re-entry centers.

It is most known recently for the prison stock that Michael Burry invested in after a bearish outlook that dumped stocks like Alphabet and Meta which occurred Q3 of 2022.

It’s price has declined due to dividend cuts in 2021 and interest rates making it difficult to pay down debt. However it remains a fairly cheap stock with unfortunately increasing need.

MDC Holdings

M.D.C. Holding is engaged in the homebuilding and financial service industry. Homebuilding is primarily under the Richmond American Homes brand and operates across more than a dozen states.

Interest rate headwinds are holding the price down but we believe that they are overly depressed relative to future outlook and strong fundamentals.

AGRO Adecoagro S.A.

AGRO is a agricultural company in South America involved in the planting and sale of grains, wheat, corn, soybeans, cotton, and other agricultural commodities. It owns farms in Argentina, Brazil, and Uruguay.

Deglobalization and political tensions have increased the need for stronger and more redundant supply chains. South America is relatively isolated from the simmering tensions in Europe and Asia but has its own issues with political instability.

Overall, this is a reasonable play on critical inflation-resistant commodities.

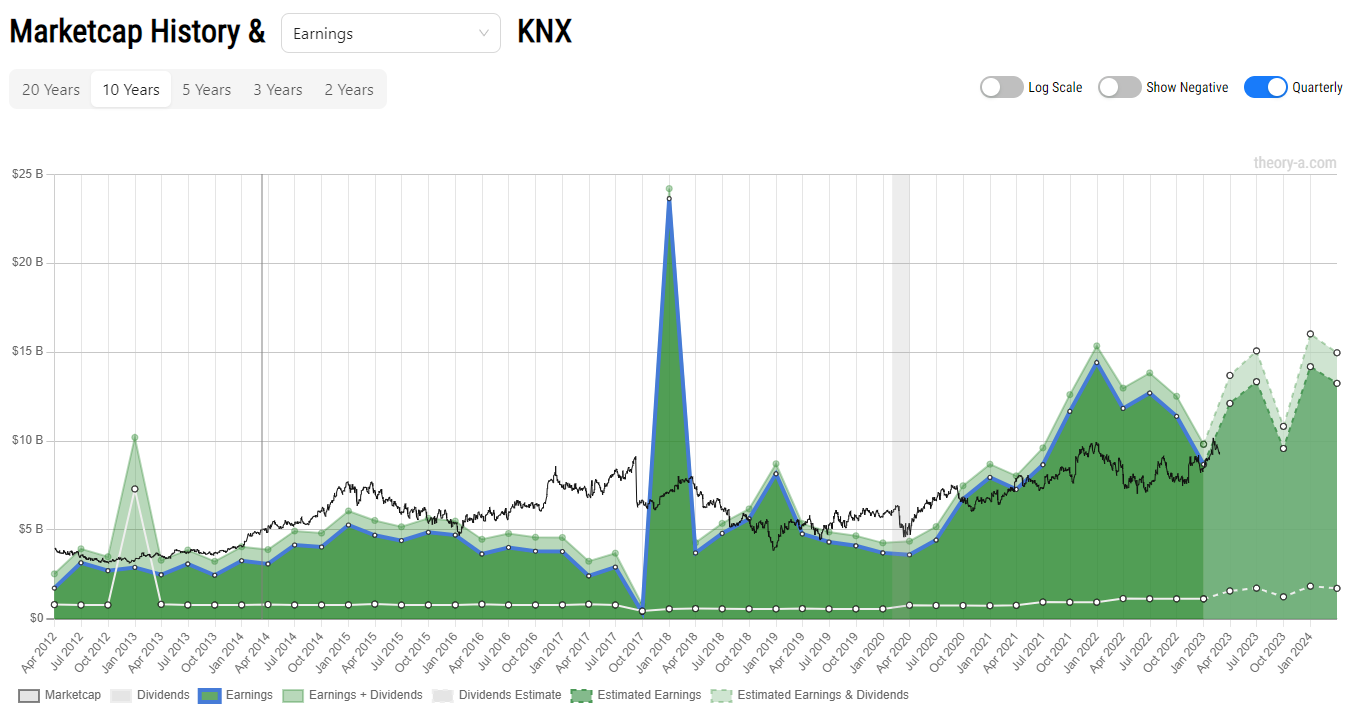

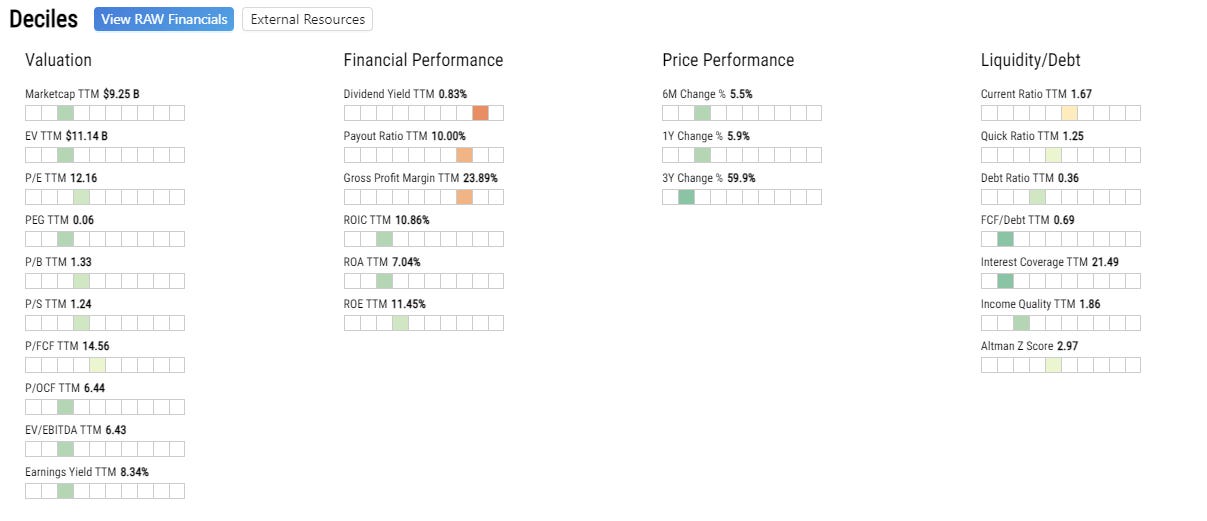

KNX Knight-Swift Transportation Holding

KNX provides transportation services across the US, Mexico and Canada. As supply chains re-route in expectation of a less globalized world, KNX is poised to profit from the increased inter-connection within North America.

Future expected earnings and fundamentals are solid.

Summary

The final list for “ROIC Value” is: