New Model Portfolio: "Decent Dividends"

As mentioned in previous posts, we will be creating some model portfolios with Theory A to walk users through how to use the platform to create their portfolios. All portfolios can be publicly followed via the M1 investing platform (referral link) which allows portfolios to be composed of slices like a pie.

50,000 USD will be deployed across 5 “themes”. Each theme will have have 1K added every month to mimic a dollar cost average until it reaches 10K. Each pie will also maintain a 20% allocation to SHY for rebalancing purposes. The target number of holdings will be 20 tickers.

The first theme will be:

Decent Dividends

Dividend stocks, as explained in a previous post, are attractive because dividends act as an anchor to reality. The company has to manage and improve its existing cashflow rather than rely on lofty valuations based on future promises which in turn are heavily reliant on low interest rates.

The “Decent Dividends” aims not to maximize dividends which is naive but to look for companies with healthy cashflows as well as a commitment to returning excess cash to shareholders.

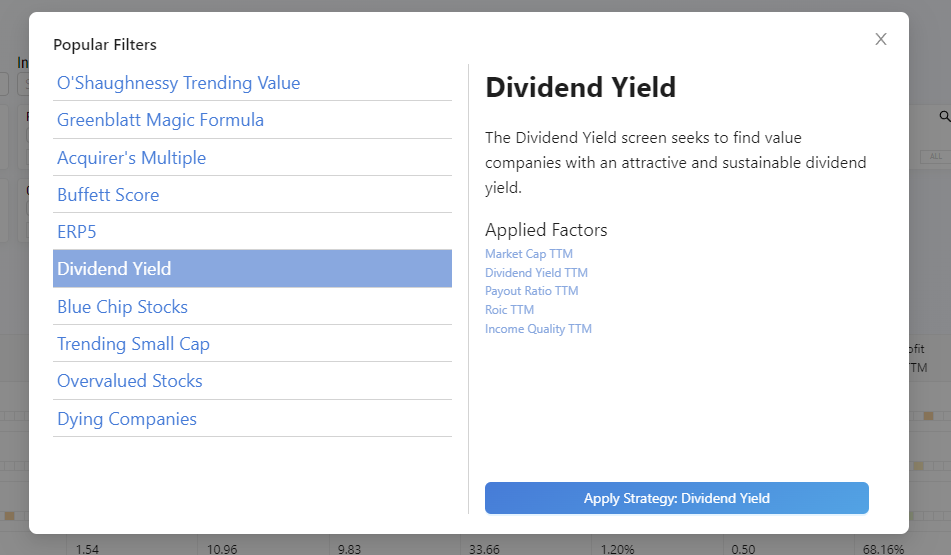

The Dividend Yield preset is a good starting point.

The filter can be seen at this URL

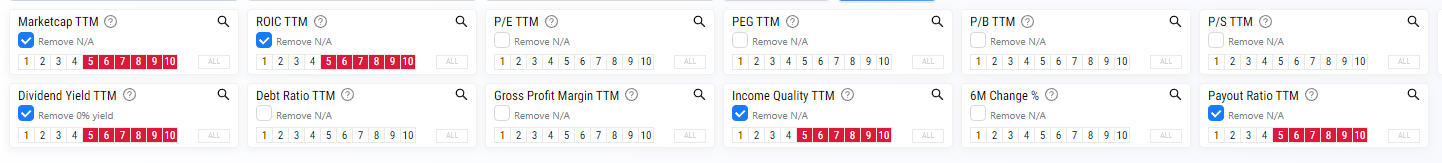

Market Cap: top 40% for stability

ROIC: top 40% as a filter for being able to turn money into more money.

Payout Ratio: top 40% to indicate commitment to shareholders

Dividend Yield: top 40%

Income Quality: top 40% to filter for healthy cash flows w/o accounting tricks.

This yields around 40 candidates for deeper analysis. Below is a overview of a few of that made it into the portfolio. The full list will be summarized at the bottom but the final portfolio on M1 can be seen here at Decent Dividends.

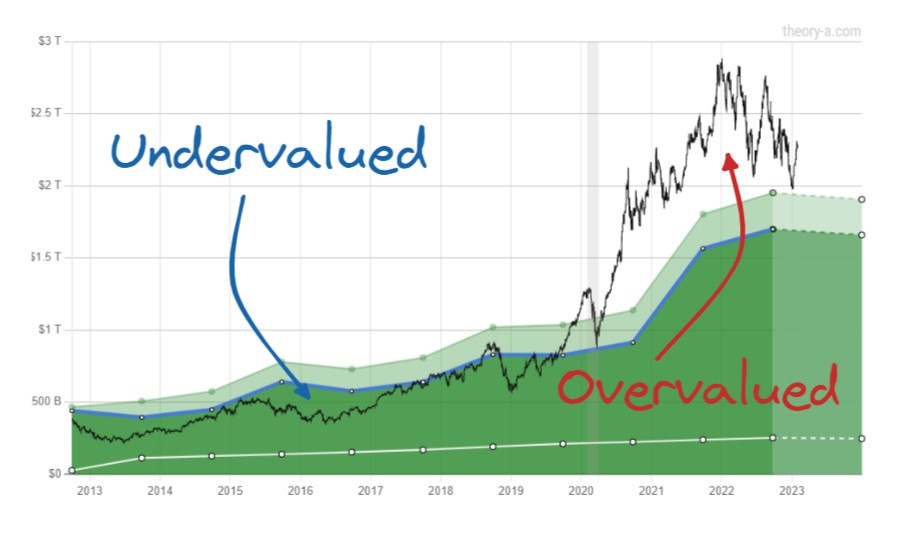

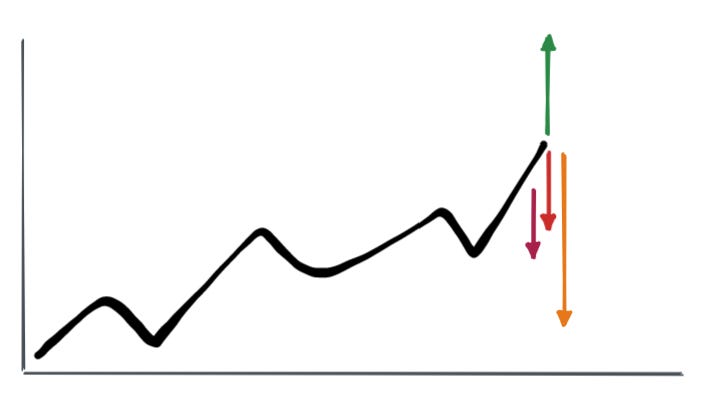

The general process for analyzing companies is to look for undervaluation based on how a stock has historically been valued. Stocks with spotty data or only a few years of data are best avoided.

Here are a few examples.

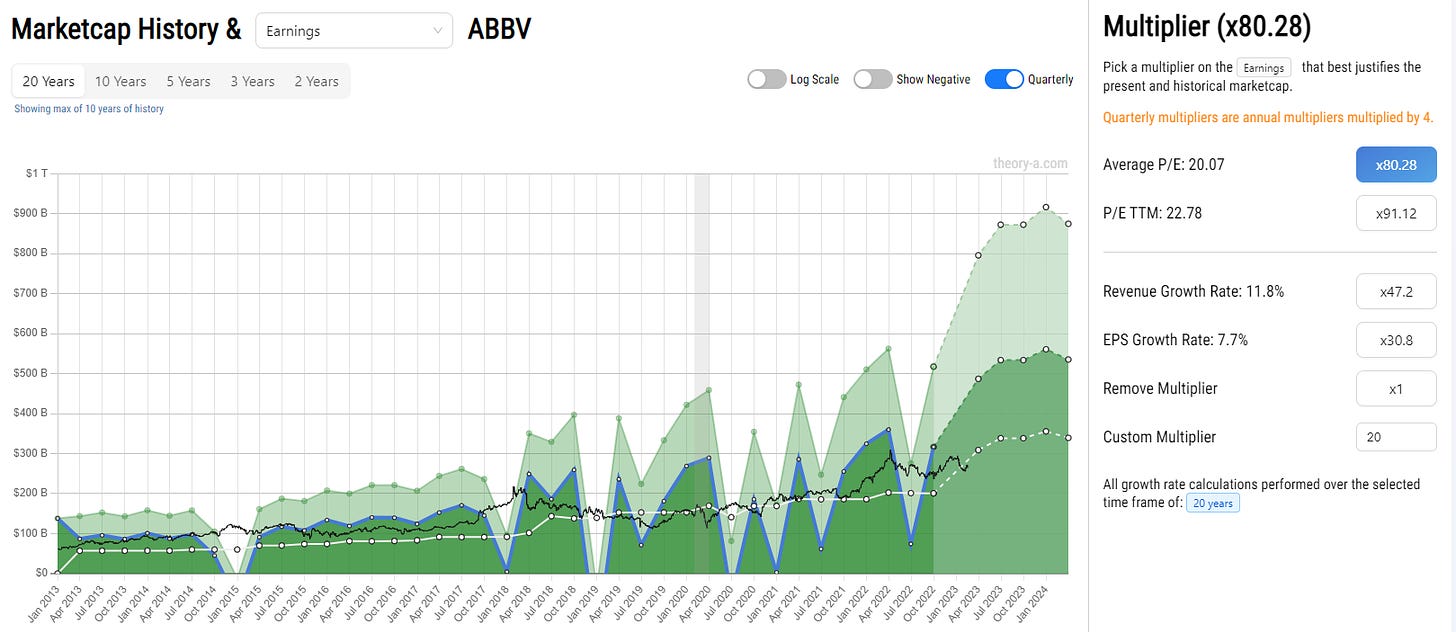

ABBV AbbVie

AbbVie is a pharmaceutical company with decent projected future earning.

It is somewhat overpriced relative to its fundamentals compared to other stocks but that is expected given it’s financial performance. It also has very good price momentum over the last 3 years.

Healthcare is an industry that usually keeps up with inflation and is set to grow due to aging demographics. With a payout ratio of 85%, ABBV is an excellent hook into this cashflow.

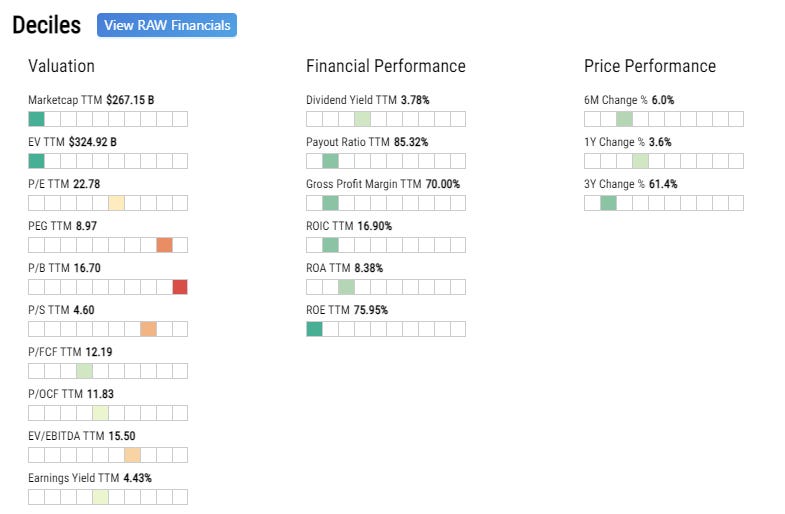

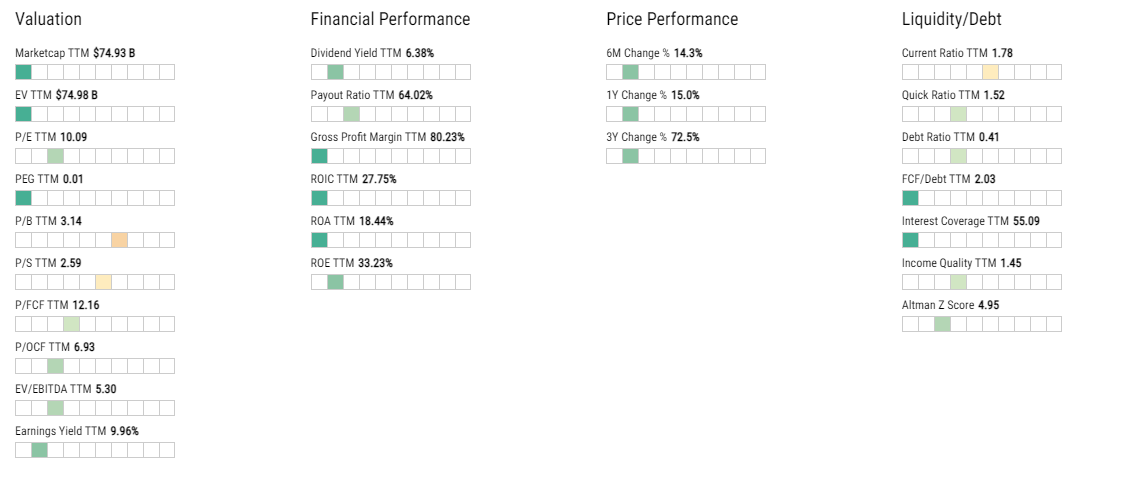

VZ Verizon

Verizon is a company whose stock price has done terribly in the past few years especially after Warren Buffet dumped his shares.

However the lower price increases the dividend yield which could make it more attractive to dividend seekers. Given that the internet is now a necessary commodity and commodities tend to keep pace with inflation, Verizon looks like a great deal.

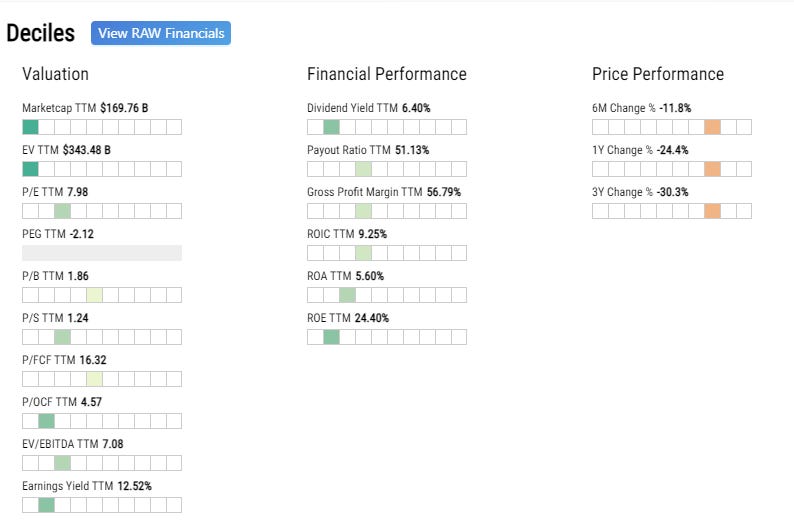

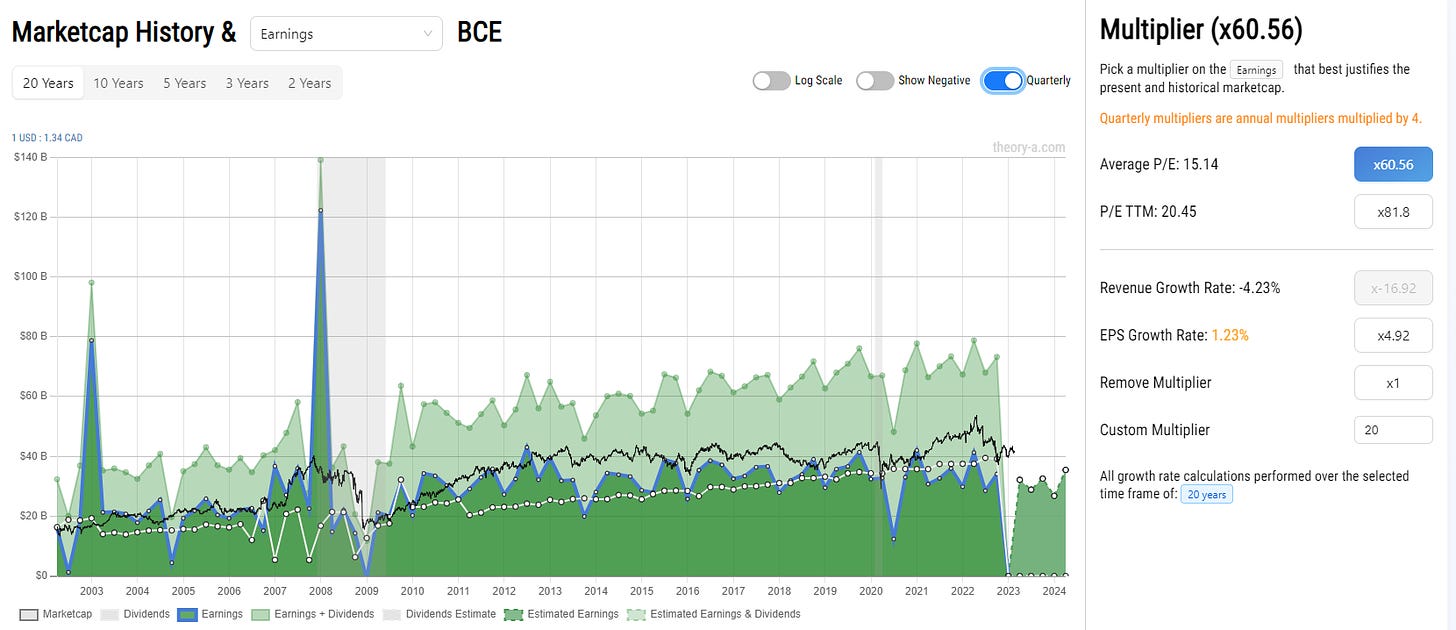

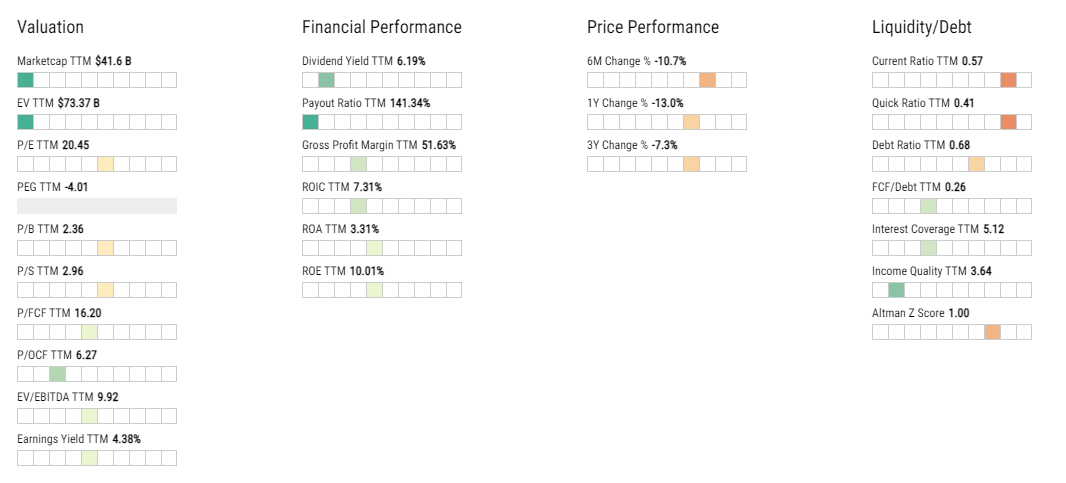

Anti Example: BCE

BCE is a Canadian telecommunications company that is a good example of a company that is best to pass on. The forward expected earnings growth is mostly flat.

As is the sales.

Despite its decent financial performance and high dividend yield it looks to still be coming off it’s 2022 highs.

The payout ratio of over 100% also means that the company’s earnings do not support the dividend and it is being financed through debt or other means. This can negatively affect the long term sustainability of the company especially if interests rates rise and make servicing the debt difficult.

There is less of a margin of safety compared to VZ so this company does not make it into the portfolio.

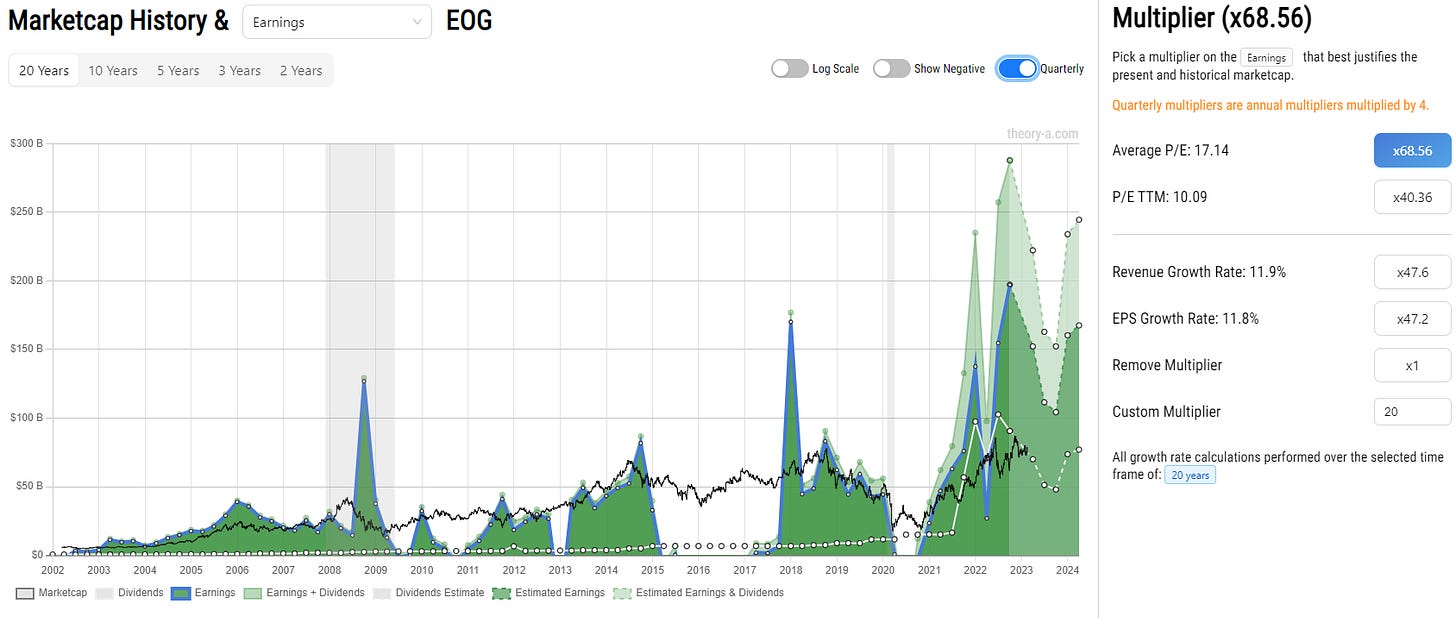

EOG Resources

EOG Resources is an oil and natural gas company with excellent all-around performance.

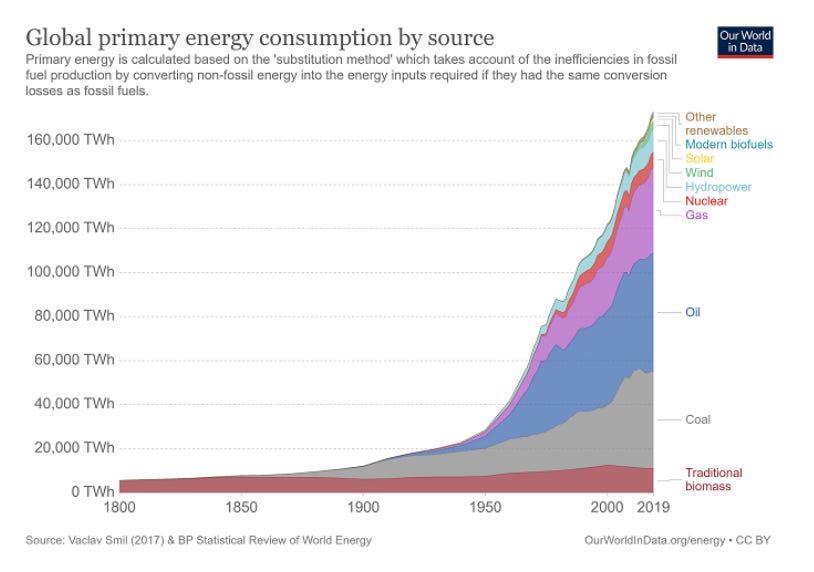

The price is likely suppressed due to ESG initiatives and rapid innovation in renewables such as solar, wind, and fusion. However, as Lyn Alden explains, despite the fast pace of innovation, the world is still mostly powered by traditional sources of energy and will be for the foreseeable future as countries modernize and come to expect energy intensive features like air conditioning and cars.

This makes EOG an attractive stock both for its dividend yield and for potential price appreciation as the market figures this out.

As explained in Profiting from Efficient Market Hypothesis, the current price is likely held down by a transient downward force, overly idealistic hype about innovative technologies.

There are however upward transient forces as well (e.g. the war in Ukraine creating limitations on supply and increased energy prices) so it’s important to dollar cost average into any position intended for a long holding period.

Summary

As can be seen with the above examples, Theory A allows investors to screen and analyze stocks in a way that compress massive amounts of information into intuitive understanding. Value can be compared not only across space (with other companies) but also across time (with its own historical valuation).

With this as a solid foundation, investors can further apply their own knowledge such as industry domain expertise or an informed macro outlook.

The final list for Decent Dividends are:

The portfolio has been seeded with $1000 on 2/17/2023. $1000 will be added every month until 10K has been added to the portfolio.