Model Portfolio: Value Momentum

The Value Momentum portfolio looks for undervalued stocks with decent price momentum. It is heavily inspired by the O'Shaughnessy Trending Value screen described in the book "What Works on Wall Street" by James O'Shaughnessy.

It is important to understand that “value” screens do not look for “cheap” stocks that ought to justify a higher price but look for stocks that do not seem to have a great future.

It’s the equivalent of going to a Goodwill instead of an Apple store to find some hidden gems. Most things are not going to be of great quality, but because there is less popularity, there is greater room to apply skillful appraisal.

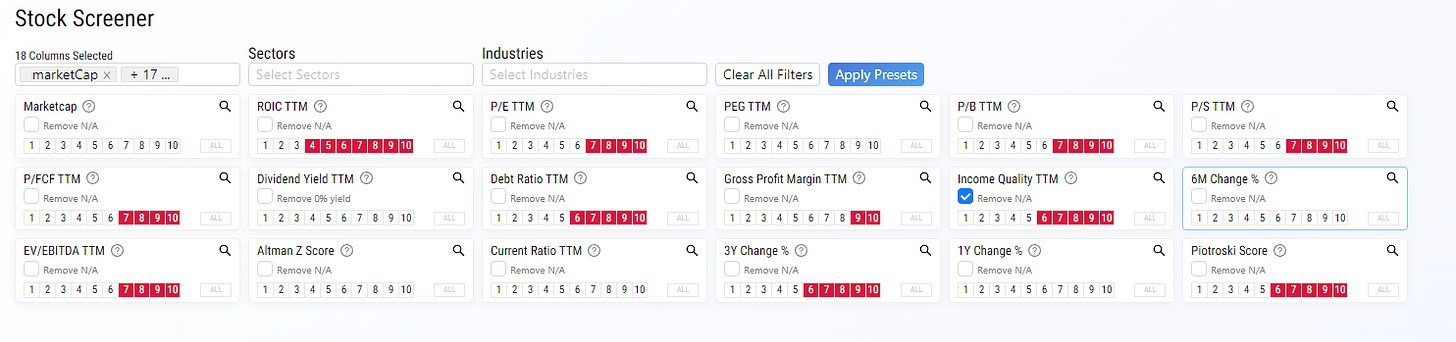

This filter works by removing stocks that score the last 40% for the most common valuation ratios such as P/E, P/B, and P/S. This is the traditional approach for value screens.

Due to current financial conditions, it further looks for companies that have higher gross margins, income quality, and are in decent financial shape (using the Piotroski score as a proxy)

As a final filter, it looks for stocks that are in the top 50% by price appreciation over the last 3 years. This helps filter for stocks that are more “lively” and have some momentum. 3 years is better than 6 months because stocks that have appreciated a lot in the last 6 months may be driven mostly by hype or have been fully priced in.

Here are a few of the stocks that make it into the final portfolio.

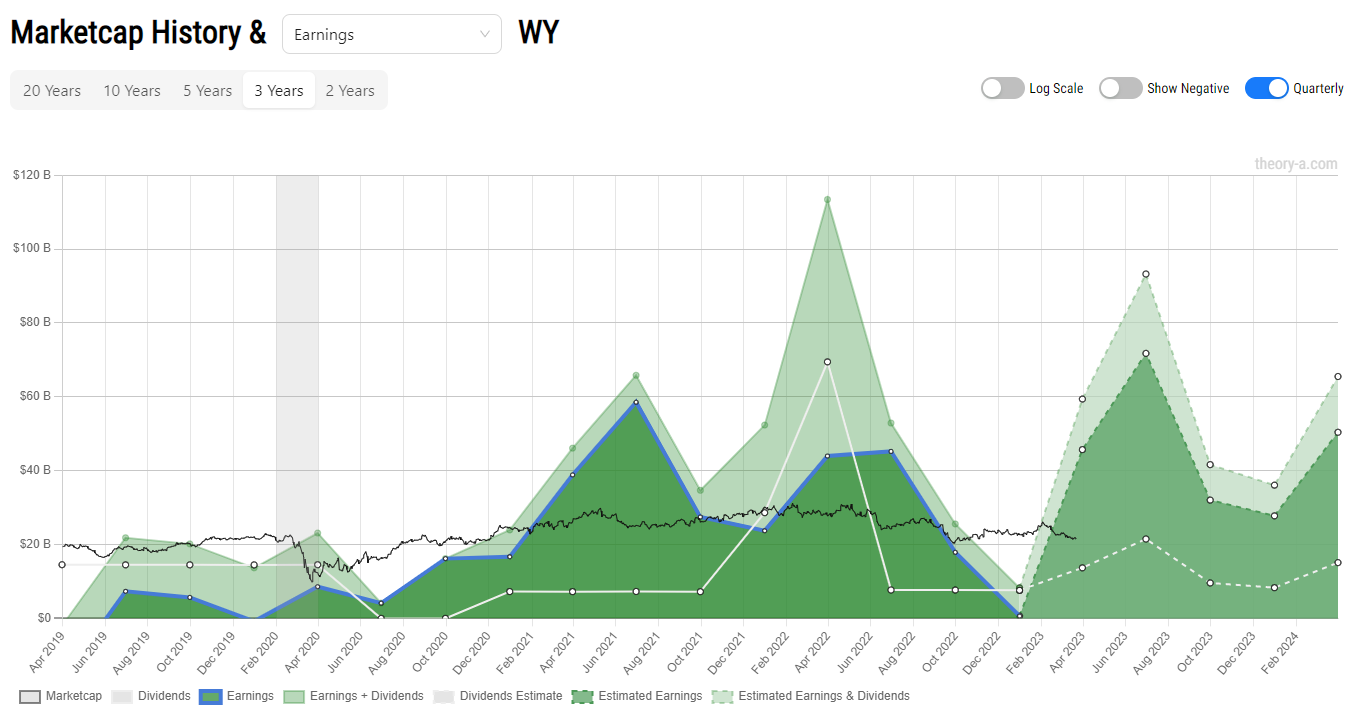

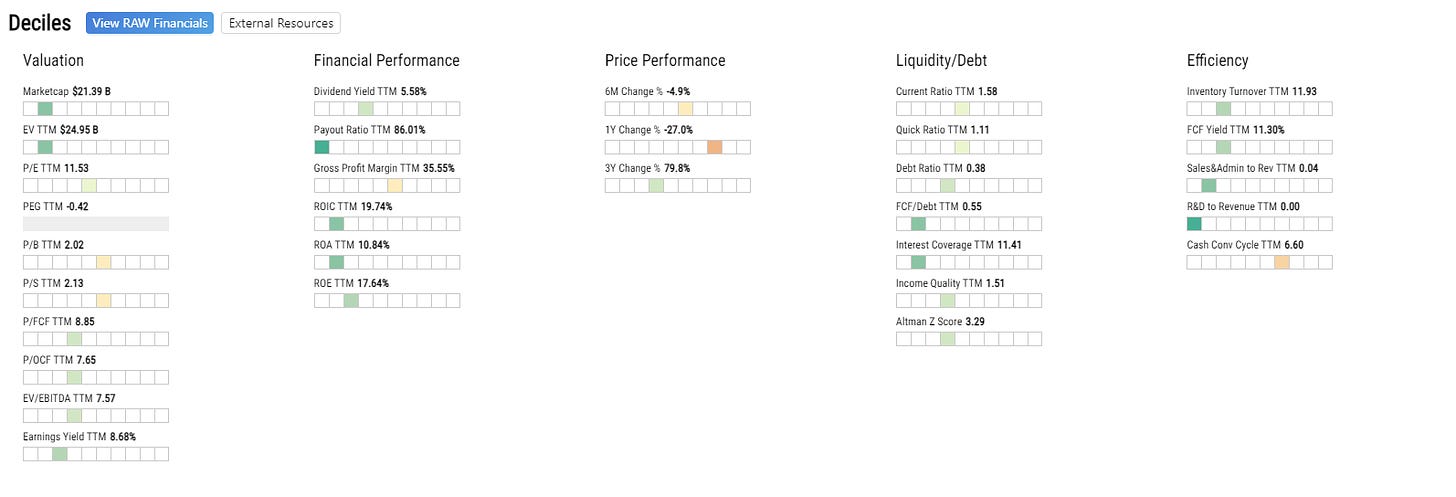

WY Weyerhaeuser Company

Weyerhaeuser Company is one of world’s largest owners of timberlands and producer of wood products. Though prices were somewhat elevated during the COVID housing boom and lumber squeeze, prices have now stabilized to fair value.

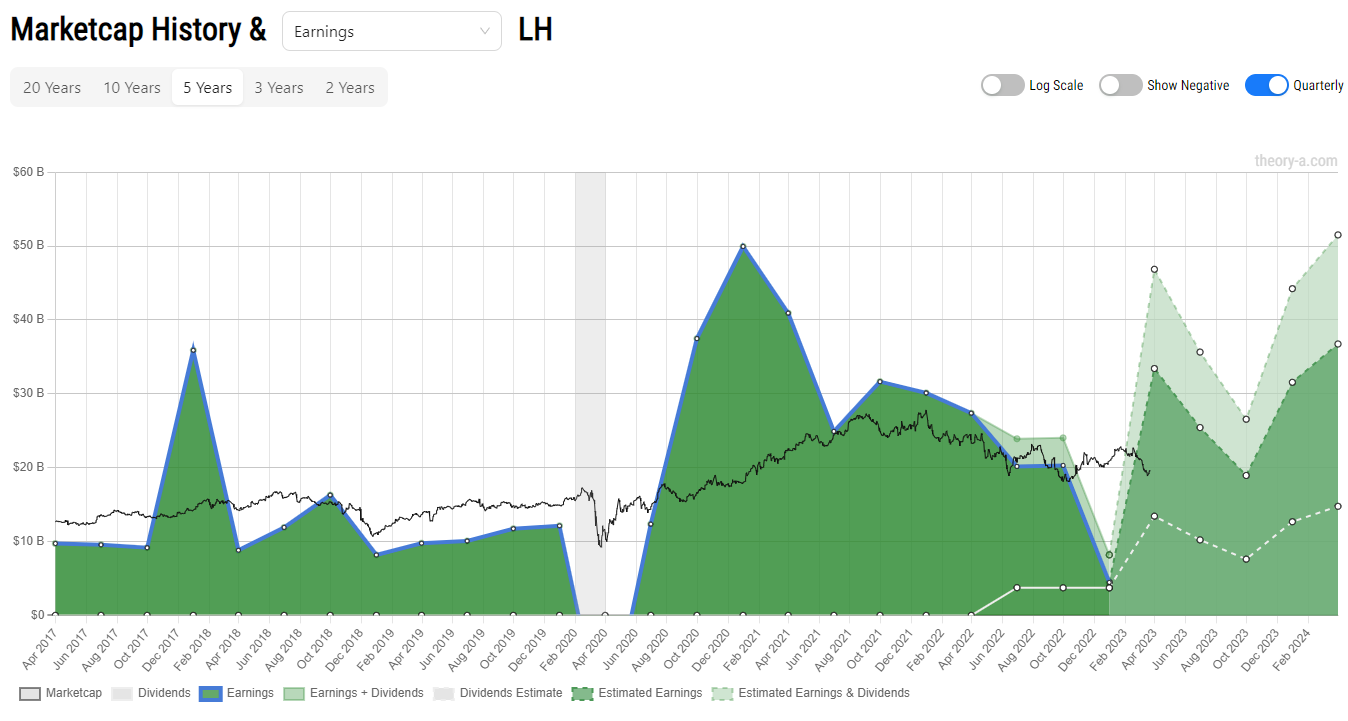

LH Laboratory Corporation of America Holdings

Labcorp is a global life sciences company that operates one of the largest clinical laboratory networks in the world. Prices were inflated during COVID due to a need for testing however financials and future expected earnings remains strong. The healthcare industry is expected to grow with an aging U.S. population as well as keep pace with inflation.

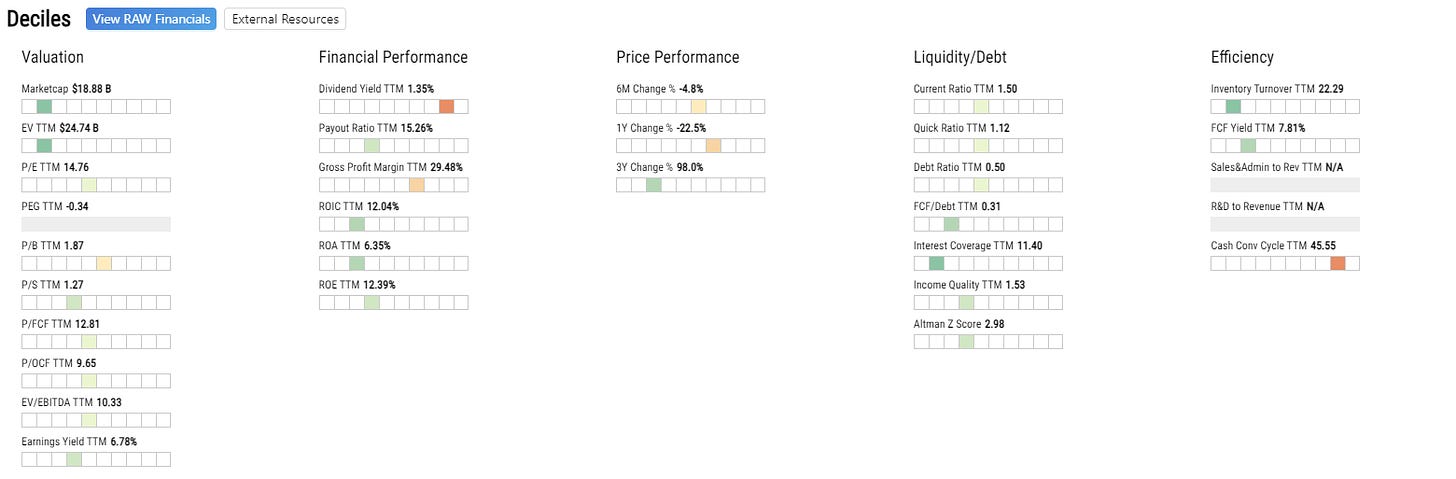

L Loews Corporation

Loews Corporation (ticker: L) is a diversified holding company with subsidiaries in various industries, including insurance, energy, and hospitality. It positions itself as investing in long term value. The recent pullback combined with future outlook and strong financials makes this a good entry point to start accumulation.

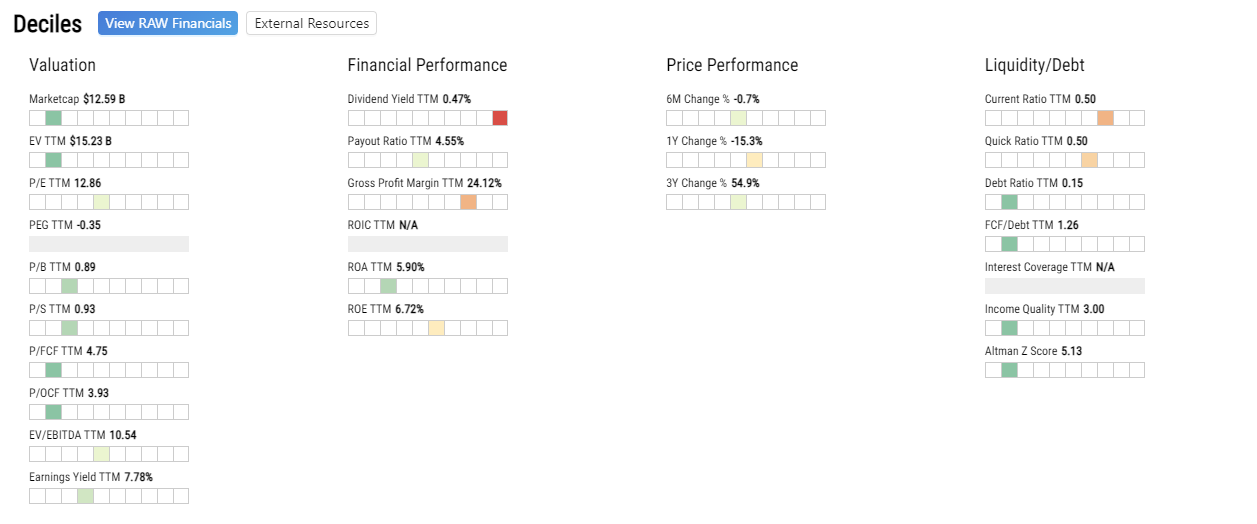

IPI Intrepid Potash

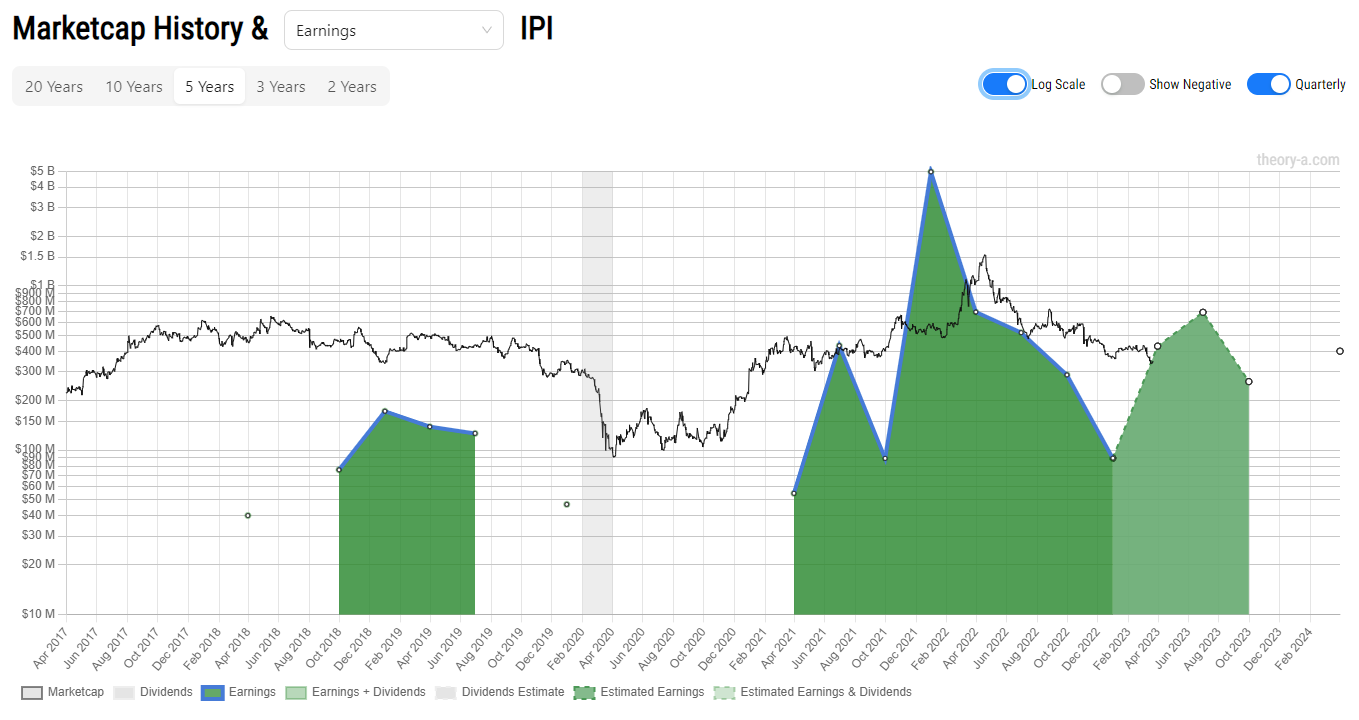

Potash is a critical input for the agricultural market as it a key component of fertilizer. There was a large spike in earnings and valuation at the outset of the 2022 Ukraine-Russia war. To put this spike into context, the chart below toggles on the log scale to make comparison easier.

The price has fallen from it ATH but potash remains a critical commodity. Valuation metrics tell us that most of the hype is over and that now is a decent price to begin accumulation.

Summary

The full list can be found on M1 here and contains: