Model Portfolio: Too Big to Fail

The core of the FIRE movement revolves around dollar cost averaging into a low cost SPY index fund as even professional investors often cannot beat the market.

It’s an approach recommended by Warren Buffett and historically has an average annual return rate of 7-8%.

However many recommended index funds are weighed by market cap. Most of the returns for the SPY from the last decade have been from tech stocks meaning that the return for the last 2 decades has mostly been tech stocks minus the baggage of aging incumbents and zombie companies.

This does not sound very appealing…

In our view, buying the SPY and buying GME or Dogecoin are similar in that they both rely on faith rather than judgement and rational analysis. Whether it’s faith in Warren Buffett & Charlie Munger or faith in memes and Elon Musk, the act of thinking for yourself is outsourced to a higher authority.

However the “Too Big to Fail” portfolio is based around the idea that the SP500 is now too big to fail because so many are using it as a de-facto pension fund. Using this constant source of demand as a base, we then use the Theory A suite of tools to select a higher quality subset from the index with the hopes of outperforming the index.

This type of selection can be appealing for investors who want to follow the crowd for safety, but also make some individual decisions and have more visibility and control over their portfolio.

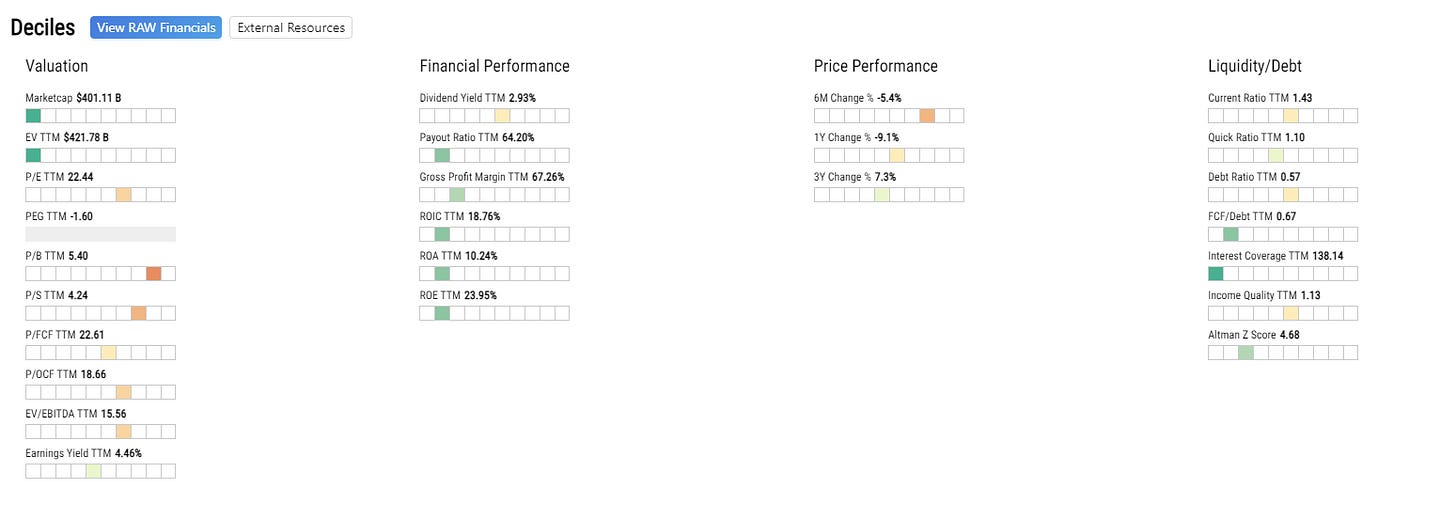

The initial screener checks for these attributes:

Top 10% by market cap

Top 40% by gross profit margin

Top 40% by Altman Z Score (A measure of credit risk)

Top 40% by Interest Coverage (How easily a company can pay down its debt)

Here is a list of some of companies that made the list.

1. ADBE Adobe

Adobe has been a dominant player in the world of design for many years and with its purchase of Figma, will continue to maintain relevance amongst product and marketing teams across all companies.

Adobe’s price reached a peak late 2021 along with many other remote work stocks but at the current price point feels fairly valued with strong cashflow and reasonable growth expectations unlike companies such as Zoom which have been unrealistic with their growth estimates.

As with many other large cap stocks, it is not exactly cheap with a P/E ratio of over 30 but maintains strong financial performance.

2. JNJ Johnson & Johnson

JNJ sells many well-known healthcare brands such as Tylenol and Neutrogena and also offers various pharmaceuticals.

It’s financial performance is strong and the recent dip is a good opportunity to start building a position.

3. INTU Intuit

Taxes are an unavoidable part of life. While not undervalued, INTU is now fairly valued and has some expected future growth.

The above is the annual earnings while the quarterly earnings chart below chart shows the large spikes in earnings around tax time. It is always useful to compare the annual and quarterly charts to see when a company makes its money.

4. QCOM Qualcomm

Semiconductors are critical to technology. While technologically not as advanced or critical as ASML it maintains a healthy cashflow and future earnings and is not as hyped with a P/E ratio that is 4 times lower.

UPS United Parcel Service

UPS has had a large and consistent boost in earnings ever since COVID. However the market does not seem to be pricing it in fully, likely due to recession fears. While there is a risk there, we believe the fears are already priced in. The 3% dividend yield is also not bad.

MRK Merck & Co.

MRK is a healthcare company that also develops for animal health. With aging boomers and all the new pet owners due to COVID, this is a strong stock to own with its 50% payout ratio.

The current price is somewhat elevated but still fairly valued especially as we will be dollar cost averaging into the positions over the coming months.

Anti Example: CMG Chipotle

Chipotle is a strong business with a great return on capital. However the goal of investing is to buy at the right price. Chipotle’s P/E ratio is similar to that of tech companies while it’s future expected earnings are sideways and somewhat downwards from its current position.

It is better to avoid company’s that are valued because of popularity unless you are a very active investor and have insight into when trends will break.

However investors who love a company can still “own” the company by selling puts. Based on our chart below, $1250 is a fair valuation and investors can sell cash secured puts around that price to feel that they are betting on and owning CMG without have exposure to the present elevated prices.

Summary

The final list can be found here and includes:

Reminder that the total portfolio of portfolios currently has 4 and will finish next week with the fifth and final portfolio “Value Momentum”