Model Portfolio: Smart Alpha

The term “Smart Beta” describes a portfolio strategy that curates a beta strategy like buying the SPY and curates or adjusts it for better returns. E.g. buying the half of the SP500 that has the lower P/E value.

Our 3rd portfolio: “Smart Alpha” uses the Theory A platform to curate a selection of stocks from an already curated set. It uses:

Promising Stocks by Vlad Chernikov who is the creator of ROIC.ai. The spreadsheet contains stocks that have strong moats.

So what is the definition of a "good business?" Is it something that’s cheap enough or something that’s growing fast? The answer lies in not even close to these parameters. It’s all about an incumbent’s stability and market share. All these multi-staged DCF approaches, GARP stocks, Lynch’s baggers, Graham’s lost formulas, Piotroski scores, and undervalued securities by 10+ metrics matter nothing if a company under consideration is in a competitive industry.

Top Stocks by Lyn Alden who maintains a curated list of stocks for her premium subscribers.

Here are some of the stocks that make it into this portfolio:

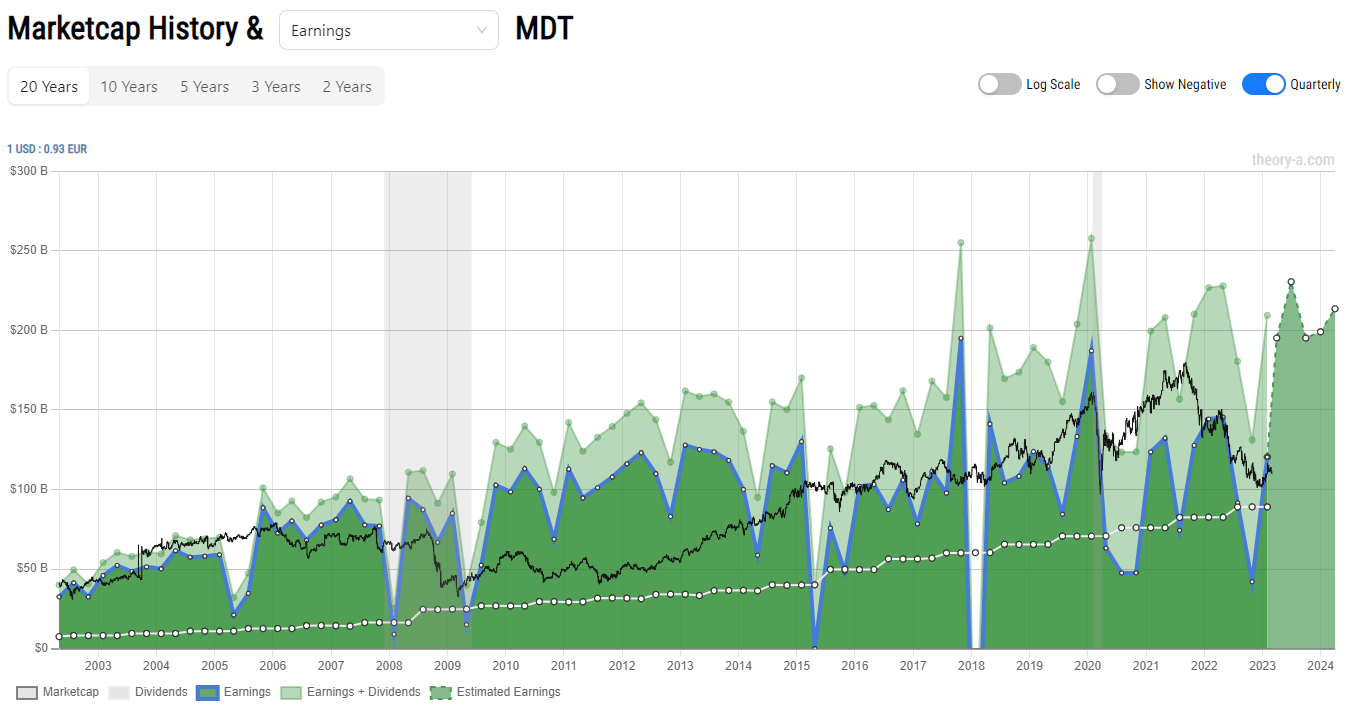

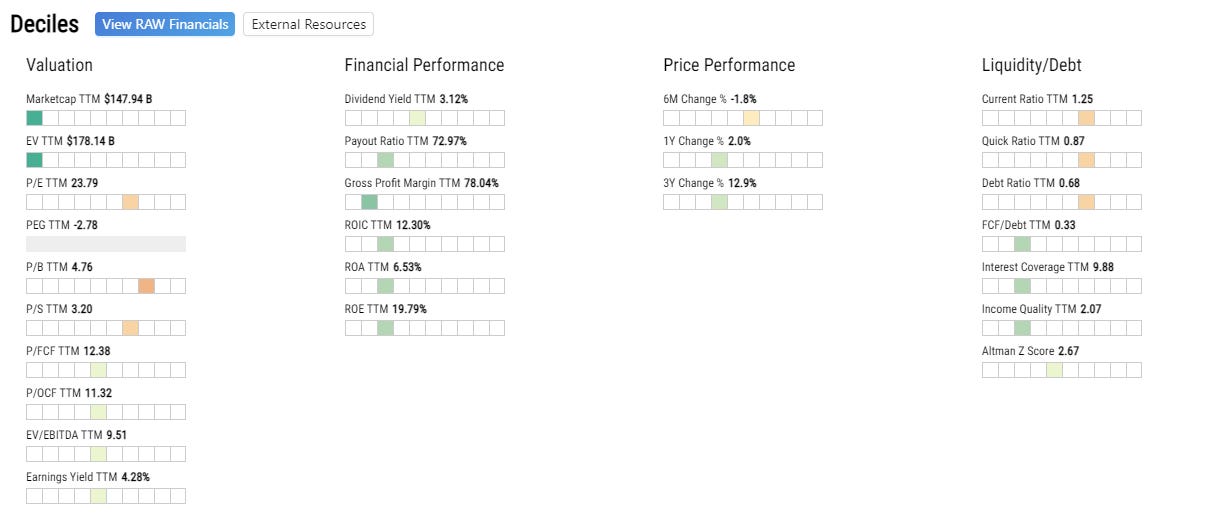

MDT Medtronic

Medtronic is a medical devices company with a strong moat, owning over 60% of the global pacemaker market. It is only moderately cheap in terms of value ratios but has great financial performance and strong expected future earnings.

It’s performance over the last few years hasn’t been very good but strong fundamentals point to a turnaround in the coming years.

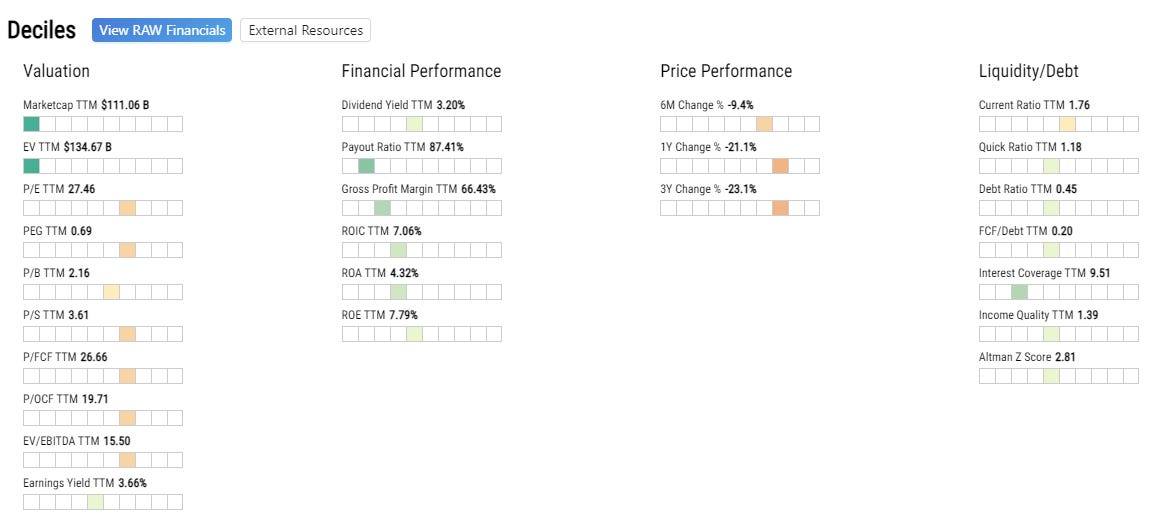

QCOM Qualcomm

Qualcomm is a tech company with one of the lowest P/E ratio and owns over 60% of the phone chipset market. It’s return on capital continues to be great and future expected earnings are expected to be strong as well.

BMY Bristol-Myers Squibb Company

BMY is a large pharmaceutical company with a strong pipeline of drugs in development. If all goes well with clinical trials, future earnings are expected to soar.

CI Cigna

Cigna provides insurance and other health related service in the U.S. It is a decent stock at a fair price. It is included here as an example of a stock that is fairly valued. Lyn Alden provides a deep dive for premium members.

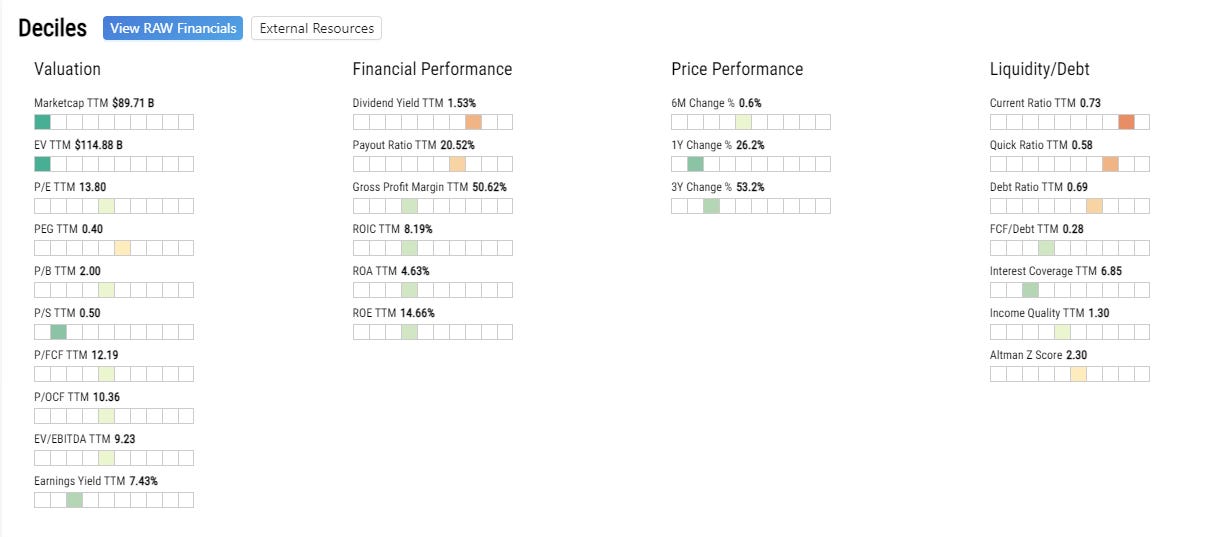

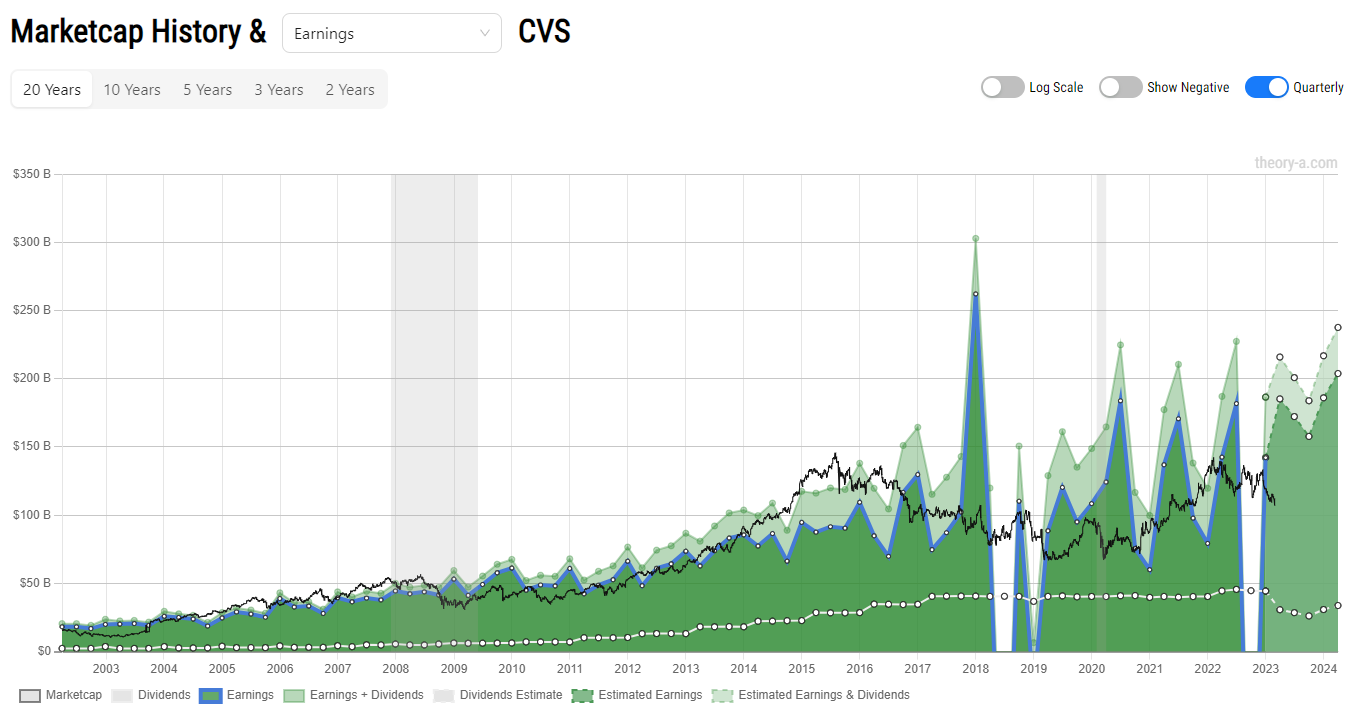

CVS Health Corporation

CVS is a combination of pharmacy, pharmacy benefits manager, in-store clinics, and health insurer (most recently with its acquisition of Aetna in 2018). Though it took on a lot of debt for these purchases, it is poised to take advantage of this integration in the coming years and is currently on the low end of its historical valuation.

Summary

The full portfolio can be found on M1 here.